You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

ECB Faces Rising Inflation and Uncertain Policy Path

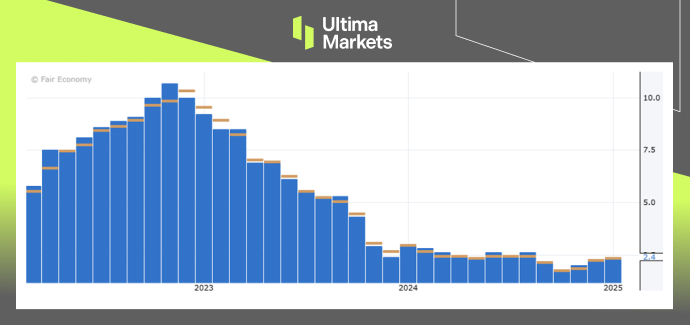

主題Eurozone Inflation Rises to 2.4% Amid Energy and Service Costs

Inflation in the Eurozone accelerated in December, rising to 2.4% from 2.2% in November, in line with expectations, due to rising energy prices as well as services sector costs. The euro dipped 0.48% against the U.S. dollar, closing at $1.034.

(Eurozone’s Inflation Chart, Source: Eurostat)

(EUR/USD Daily Price Chart, Source: Trading View)

Core inflation, a key indicator of the sustainability of price growth, remained stubbornly high. This could bolster arguments for the European Central Bank (ECB) to adopt a cautious approach in easing policy restrictions over the coming months. Supporting this cautious stance, a separate consumer survey by the ECB revealed rising near-term and medium-term inflation expectations. Projections for inflation three years ahead climbed to 2.4%, up from the previous survey’s 2.1% and exceeding the ECB’s target.

While inflation has spiked upwards and gotten close to the 2 percent that the ECB has been targeting in recent times, the upcoming data can still be unstable. Nonetheless, a decline is expected in the longer to mid-term, even more so in the last half of the year in regard to the target set by the ECB.

Last year, the interest rates were cut multiple times by the central bank indicating that inflation was almost within grasp. More easing policies are bound to be released but the pace as well as the time frames remain unknown for the time being. Investors are increasingly skeptical about rate cuts at every meeting through June, with a 50% chance that the ECB might skip a meeting during the first half of the year.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

隨時隨地留意市場動態

市場易受供求關系變化的影響

對關注價格波動的投資者極具吸引力

流動性兼顧深度與多元化,無隱藏費用

無對賭模式,不重新報價

通過 Equinix NY4 服務器實現指令快速執行