You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Tokyo Inflation Boosts BOJ Rate Hike Expectations

主題Tags: BOJ, Factory Output, Inflation, Rate Hike, Tokyo

Tokyo Core Inflation Rises, Factory Output Falls

In December, core inflation in Japan’s capital city rose, while inflation in services remained stable, according to data released on Friday, keeping market speculation alive that an interest rate hike could occur soon. However, factory production dropped in November for the first time in three months, signalling that weakening global demand is impacting the export-dependent economy.

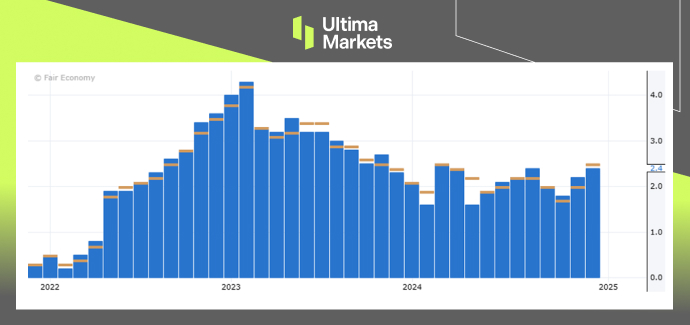

The Tokyo core consumer price index (CPI), which excludes the volatile prices of fresh food, climbed by 2.4% in December compared to the previous year, slightly below the market expectation of a 2.5% increase. This followed a 2.2% year-on-year increase in November. Another index, which excludes both fresh food and fuel prices and is closely monitored by the Bank of Japan (BOJ) as a better reflection of demand-driven inflation, rose 1.8% in December, down from a 1.9% increase in November.

(Tokyo Core CPI y/y. Source: Statistics Bureau)

Service prices in Tokyo increased by 1.0% in December, up from a 0.9% rise in November, reinforcing the BOJ’s view that ongoing wage growth is encouraging businesses to raise prices for services.

The Tokyo inflation figures, seen as an early indicator of nationwide trends, are closely monitored by policymakers for insight into how much progress Japan is making toward consistently meeting the BOJ’s 2% inflation target, which is crucial for further rate hikes. Market participants are anticipating that the BOJ will raise rates to 0.5% by March of next year, with heightened focus on whether such a hike will be announced at the central bank’s next meeting on January 23-24.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

隨時隨地留意市場動態

市場易受供求關系變化的影響

對關注價格波動的投資者極具吸引力

流動性兼顧深度與多元化,無隱藏費用

無對賭模式,不重新報價

通過 Equinix NY4 服務器實現指令快速執行